- Store

- >

- On-Demand

- >

- Creating Insightful Multifamily Dashboards with Microsoft Excel - Step-by-Step Instructions from a Seasoned Asset Manager - OD

Creating Insightful Multifamily Dashboards with Microsoft Excel - Step-by-Step Instructions from a Seasoned Asset Manager - OD

SKU:

$139.00

$139.00

Unavailable

per item

On-Demand Training

Original webcast aired June 4, 2020

Run time: 2 hours

Terms: Purchase of this training entitles Purchaser to unlimited viewings of the recorded original webcast for up to 14 days from date of purchase. The training video is not downloadable, but rather is viewable in MP4 format online at our GoToWebinar portal.

About This Training

CEOs, CFOs, board members and staff responsible for line of business productivity and profitability digest large sums of financial and other information in their respective roles within an organization. Multifamily owners, operators and other stakeholders rely on concise information to evaluate rental assets across a host of metrics. How do you monitor the performance of your multifamily portfolio? Does your organization employee best practices for tracking actual performance of real estate assets against stated objectives?

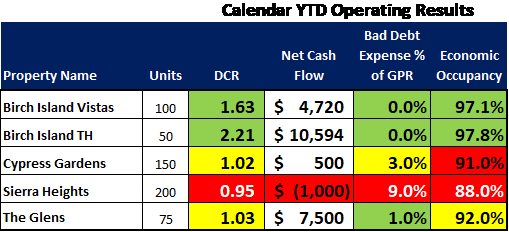

I invite you to join me for a special two-hour training in which we create elements of a multifamily portfolio performance dashboard from scratch using Excel. Over my 30+ years in multifamily affordable housing, I have created a variety of performance evaluation tools for employers and clients, alike. We’ll design basic dashboard elements that capture various financial data and time-sensitive data in spreadsheet tabs that links to a second at-a-glance dashboard. We’ll incorporate several key multifamily industry metrics including net cash flow, debt coverage ratio and economic occupancy; we'll also review a 'back of the envelop' potential equity calculator. As an on-demand attendee, you'll receive copies of two MS Excel spreadsheets that we designed during the actual webcast.

Is this Webcast for Me?

If you’re looking to implement a multifamily dashboard for your organization’s portfolio in or want to enhance existing asset management tools, this webcast is for you. The training is ideal for:

Please contact Vinnie at 617-905-6340 or [email protected] with any questions about this training.

About the Presenter

Vinnie Viola, HCCP, MPA, is principal and founder of Birch Island Real Estate Consulting, LLC. Celebrating its 7th anniversary in September 2020, Birch Island provides consulting services and training around asset management practices to owners, developers, operators and investors of multifamily housing funded with Low-Income Housing Tax Credit (LIHTC) equity. With over 30-years of broad experience, Vinnie has worked in for-profit, government and not-for-profit organizations that invest in, manage and regulate affordable housing. His career includes ten years in various leadership roles at Boston Financial Investment Management and Boston Capital, through which he gained expertise with asset management best practices and IRS' Section 42 program. He has asset managed thousands of rental units in hundreds of investment partnerships, comprising over $1 billion in investor contributed equity. Over his career, for clients and employers Vinnie has designed countless tools for monitoring performance of multifamily assets in development and stabilized life cycle phases. Today, as consultant to NeighborWorks America's Organizational Assessment Division, among other clients, Vinnie evaluates the profitability and business practices of NWA charter member organizations' property management and real estate development / asset management lines of business. He also serves as Director of Asset Management (part-time) for Madison Park Development Corporation, located in Nubian Square, Boston.

Original webcast aired June 4, 2020

Run time: 2 hours

Terms: Purchase of this training entitles Purchaser to unlimited viewings of the recorded original webcast for up to 14 days from date of purchase. The training video is not downloadable, but rather is viewable in MP4 format online at our GoToWebinar portal.

About This Training

CEOs, CFOs, board members and staff responsible for line of business productivity and profitability digest large sums of financial and other information in their respective roles within an organization. Multifamily owners, operators and other stakeholders rely on concise information to evaluate rental assets across a host of metrics. How do you monitor the performance of your multifamily portfolio? Does your organization employee best practices for tracking actual performance of real estate assets against stated objectives?

I invite you to join me for a special two-hour training in which we create elements of a multifamily portfolio performance dashboard from scratch using Excel. Over my 30+ years in multifamily affordable housing, I have created a variety of performance evaluation tools for employers and clients, alike. We’ll design basic dashboard elements that capture various financial data and time-sensitive data in spreadsheet tabs that links to a second at-a-glance dashboard. We’ll incorporate several key multifamily industry metrics including net cash flow, debt coverage ratio and economic occupancy; we'll also review a 'back of the envelop' potential equity calculator. As an on-demand attendee, you'll receive copies of two MS Excel spreadsheets that we designed during the actual webcast.

Is this Webcast for Me?

If you’re looking to implement a multifamily dashboard for your organization’s portfolio in or want to enhance existing asset management tools, this webcast is for you. The training is ideal for:

- Multifamily owners and operators

- Executives with REO performance responsibility

- Portfolio managers

- Asset managers and analysis

- Equity and debt funders

- Regional property managers and supervisors

- Housing agency staff that monitor multifamily projects

- Others who want to learn about dashboard best practices

Please contact Vinnie at 617-905-6340 or [email protected] with any questions about this training.

About the Presenter

Vinnie Viola, HCCP, MPA, is principal and founder of Birch Island Real Estate Consulting, LLC. Celebrating its 7th anniversary in September 2020, Birch Island provides consulting services and training around asset management practices to owners, developers, operators and investors of multifamily housing funded with Low-Income Housing Tax Credit (LIHTC) equity. With over 30-years of broad experience, Vinnie has worked in for-profit, government and not-for-profit organizations that invest in, manage and regulate affordable housing. His career includes ten years in various leadership roles at Boston Financial Investment Management and Boston Capital, through which he gained expertise with asset management best practices and IRS' Section 42 program. He has asset managed thousands of rental units in hundreds of investment partnerships, comprising over $1 billion in investor contributed equity. Over his career, for clients and employers Vinnie has designed countless tools for monitoring performance of multifamily assets in development and stabilized life cycle phases. Today, as consultant to NeighborWorks America's Organizational Assessment Division, among other clients, Vinnie evaluates the profitability and business practices of NWA charter member organizations' property management and real estate development / asset management lines of business. He also serves as Director of Asset Management (part-time) for Madison Park Development Corporation, located in Nubian Square, Boston.